Inheritance Scams in the Ivory Coast: A Warning for Online Daters

The Romance Scam of Online Dating

For many, the internet has brought love and connection that was previously out of reach. But with online dating comes deception. “Inheritance scams” are a particularly sneaky form of online fraud that target men who think they’ve found love with a woman from a French speaking country. They exploit emotions and drain your bank account. This article will explain how they work and how to avoid them.

The Scenario: Falling in Love Online

Imagine this: you meet a charming woman online who claims to be from French speaking Switzerland, France, Belgium or Canada. Her profile looks real, with photos and personal details. You quickly connect and share hopes, dreams and plans for a future together. Over time she tells you about her struggles and wins your sympathy.

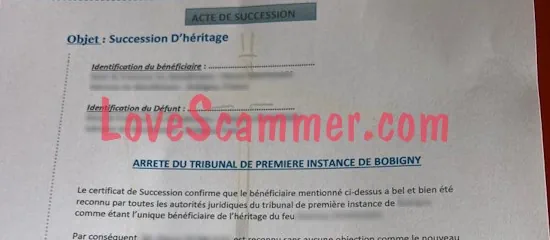

The scammers use genuine-looking documents which are, however, forged.

A Sudden Trip to Ivory Coast

As your relationship gets deeper she tells you about her father’s recent passing. According to her story, he left behind an inheritance in the Ivory Coast, including cash in a local bank. She travels to Abidjan, the economic capital, to sort out the legalities of the inheritance. While there she contacts you regularly, sending you updates and telling you how much she misses you.

The Ask to Transfer Money

Things take a turn when she encounters “unexpected” problems. She tells you her father’s former lawyer or the bank handling the inheritance is asking for administrative fees, taxes or other charges. She might even send you:

- A scanned copy of her passport.

- Bank statements or invoices from the lawyer.

- Letters from notaries or government agencies.

These documents look real and make you believe she’s telling the truth. Often, they include fake notices to make the claims seem legitimate. She’ll tell you that once these fees are paid she can access the inheritance, buy a plane ticket and be with you.

Scammers use stolen or forged passports. Don’t let a passport fool you.

The Emotional Play

The woman’s pleas become more emotional. She talks about being alone in a foreign country, being desperate and needing your help. This emotional pressure can be intense, especially if you really care. You feel compelled to help thinking that your help will bring her closer to you.

Falling into the Trap

Victims send money for:

- Lawyer’s fees.

- Bank charges.

- Taxes or customs fees.

- Plane tickets.

- Transfer fees.

But as soon as one payment is made, new “problems” arise and more money is needed. And so the cycle goes on until the victim realizes something is wrong, often too late to get the money back.

Never send money to a person you only know from the internet.

Case Study Ivory Coast Scam: Paul’s Story

Paul, a 45 year old Canadian from Montreal, met a woman named “Sophie” online. Sophie claimed to be from France but was in Abidjan sorting out her father’s estate. She sent Paul a copy of her passport, an address in the Ivory Coast and detailed invoices from a local lawyer.

At first Sophie needed $2,000 for lawyer’s fees. After Paul sent the money via Western Union, new expenses emerged: customs clearance fees, flight bookings and even a supposed bribe to local officials. Over 6 months Paul sent over $15,000.

It was only when Paul hired our detective agency to check out his dream woman that the game was over. During their investigation, our detectives found out that the alleged French woman didn’t exist and the inheritance in the Ivory Coast was just a fake and didn’t exist either.

These scammer claims were fabricated to deceive Paul into sending money, promising large sums of money from the non-existent inheritance.

The Scam Behind the Scenes

Inheritance fraud scams are well planned and executed by fraudsters in the Ivory Coast similar to what scammers from Nigeria from the famous Nigeria Connection do. They create fake profiles, steal photos and forge documents to build their credibility. In many cases the supposed lawyer, banker and even government official are part of the same criminal network.

In the Ivory Coast these scams are very common, especially in cities like Abidjan. They target men from French speaking countries or those who speak French, using cultural familiarity to build trust.

Scammers often pretend to work together with lawyers to “proof that they are legit”, but this is only another part of the scam itself.

What Are Inheritance Scams?

Inheritance scams are a type of online fraud where scammers deceive victims into believing they have inherited a large sum of money from a distant relative or a wealthy individual.

These scams often involve elaborate setups with fake documents, corrupt lawyers, and forged passports and wills. Scammers may pose as legitimate bank directors, lawyers, or government representatives to lend credibility to their claims.

The ultimate goal of these inheritance scams is to trick victims into transferring money or providing sensitive personal and financial or bank account information.

Common Tactics Used by Scammers

Scammers employ a variety of tactics to make their inheritance scams appear legitimate and to manipulate their victims. Some of the most common tactics include:

- Sending official-looking emails and documentation that appear to be from reputable sources.

- Claiming that the victim has inherited a substantial amount of money from a distant relative or a wealthy individual.

- Requesting that the victim pay fees or taxes upfront before the inheritance can be released.

- Using fake documents, such as passports and wills, to support their claims and build trust.

- Posing as legitimate bank directors, lawyers, or government representatives to add an air of authenticity.

- Utilizing machine translation sites to communicate in the victim’s language, despite often resulting in awkward phrasing and errors.

- Gathering detailed information about potential victims through online databases and social media to tailor their approach.

Red Flags to Watch Out for

Recognizing the warning signs of an inheritance scam can help you avoid falling victim to these fraudulent schemes. Here are some red flags to watch out for:

- Official-looking emails and documentation that contain spelling and grammar mistakes, which can indicate they are not genuine.

- Claims of a large inheritance from a distant relative or wealthy person that you have never heard of or had any contact with.

- Requests for fees or taxes to be paid upfront before the inheritance can be transferred to you.

- Fake documents, such as passports and wills, that are used to support the scammer’s claims and appear legitimate.

- Scammers who pose as legitimate bank directors, lawyers, or government representatives to gain your trust.

- Emails that have been poorly translated using machine translation sites, resulting in awkward or incorrect language.

- Scammers who have gathered personal information about you from online databases and social media to make their story more convincing.

Anyone you meet online could be a scammer. Be on your guard.

How to Avoid Online Scams

To avoid falling into an inheritance scam:

- Verify everything yourself. Don’t rely on what the person you met online tells you.

- Be wary of anyone asking for money. Real relationships don’t ask for money especially not in the beginning.

- Check the documents. Scammers use forged or stolen documents to look legit.

- Don’t send money. Once money is sent it’s almost impossible to get back.

- Get professional help. If in doubt, consult or private detectives to verify the person’s identity.

- Do not share your contact details with anyone you meet online. Scammers often ask for contact details to facilitate fraudulent transactions.

How Our Private Investigators Can Help

If you think the person you’re communicating with in the Ivory Coast is a scammer, contact our private detective agency. Our investigators are experts in fraud and can discreetly verify:

- The person’s identity.

- The inheritance claim.

- The lawyer, bank or any other parties involved.

Be cautious, as agreeing to facilitate the transfer of money for someone else can lead to legal repercussions, including being implicated in money laundering, a serious criminal offense.

Reporting Inheritance Scams

If you suspect that you have been targeted by an inheritance scam, it is helpful to report it to the appropriate authorities. Here are some steps you can take:

- Contact your bank and credit card company immediately to report the scam and protect your accounts.

- Report the scam to the Federal Trade Commission (FTC) or your local consumer protection agency to help prevent others from falling victim.

- File a complaint with the Internet Crime Complaint Centre (IC3) to alert law enforcement agencies.

- Keep a detailed record of all correspondence with the scammer, including emails, phone calls, and letters, as this information can be valuable for investigations.

Remember, it is essential to be cautious when dealing with unsolicited emails or phone calls that claim you have inherited a large sum of money. Never transfer money or provide personal and financial information to someone you don’t know and trust.

Don’t Wait Until It’s Too Late

The emotional impact of an inheritance scam, often intertwined with a romance scam, can be huge. Victims often blame themselves for being scammed but remember these criminals are experts in manipulation. Take proactive steps to verify the situation and save yourself from financial loss and heartbreak.

Get in Touch for a Confidential Investigation

If you’re talking to someone in the Ivory Coast about an inheritance, be aware of potential online scams and don’t wait. Our team of detectives will investigate discreetly and get you the answers you need. Protect yourself and your future by knowing who you’re dealing with.

Secure Your Peace of Mind — Contact Us Today

Your information will not be shared with third parties unless you give explicit consent.

For more details, please refer to our Privacy Policy

By submitting this message, I confirm that I have read and understood the privacy policy and consent to the electronic processing of my personal data for the purpose of establishing contact.